What Is The Property Tax Rate In Wood County Ohio . 2023 pay 2024 highest to lowest residential tax rate difference. In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. Please visit the pages on the website for additional information. Welcome to the wood county auditor. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. In accordance with the ohio revised code, the wood county treasurer is responsible for collecting two kinds of property taxes: The wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood county. The amount of real estate taxes are influenced by the value of the property which is decided by the wood county auditor and the tax levies which. If you’re looking for information on a specific property, please visit our online property search database. Below are quick links to the auditor’s most frequently used services. Below are links to real estate guidelines for wood county. Rate of taxation in wood county, ohio for 2023.

from www.buyhomesincharleston.com

In accordance with the ohio revised code, the wood county treasurer is responsible for collecting two kinds of property taxes: 2023 pay 2024 highest to lowest residential tax rate difference. Below are quick links to the auditor’s most frequently used services. If you’re looking for information on a specific property, please visit our online property search database. Below are links to real estate guidelines for wood county. The wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood county. Welcome to the wood county auditor. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. Rate of taxation in wood county, ohio for 2023.

How Property Taxes Can Impact Your Mortgage Payment

What Is The Property Tax Rate In Wood County Ohio Rate of taxation in wood county, ohio for 2023. Below are links to real estate guidelines for wood county. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. The amount of real estate taxes are influenced by the value of the property which is decided by the wood county auditor and the tax levies which. In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. Welcome to the wood county auditor. Rate of taxation in wood county, ohio for 2023. Please visit the pages on the website for additional information. If you’re looking for information on a specific property, please visit our online property search database. In accordance with the ohio revised code, the wood county treasurer is responsible for collecting two kinds of property taxes: The wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood county. 2023 pay 2024 highest to lowest residential tax rate difference. Below are quick links to the auditor’s most frequently used services.

From auditor.co.wood.oh.us

About the Auditor Wood County Auditor What Is The Property Tax Rate In Wood County Ohio Rate of taxation in wood county, ohio for 2023. Please visit the pages on the website for additional information. Below are quick links to the auditor’s most frequently used services. The wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood county. Below are links to real estate guidelines for wood county.. What Is The Property Tax Rate In Wood County Ohio.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year What Is The Property Tax Rate In Wood County Ohio 2023 pay 2024 highest to lowest effective tax rates approved by the voters. Below are links to real estate guidelines for wood county. In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. If you’re looking for information on a specific property, please visit our online property search database. Below are quick links to the. What Is The Property Tax Rate In Wood County Ohio.

From elatedptole.netlify.app

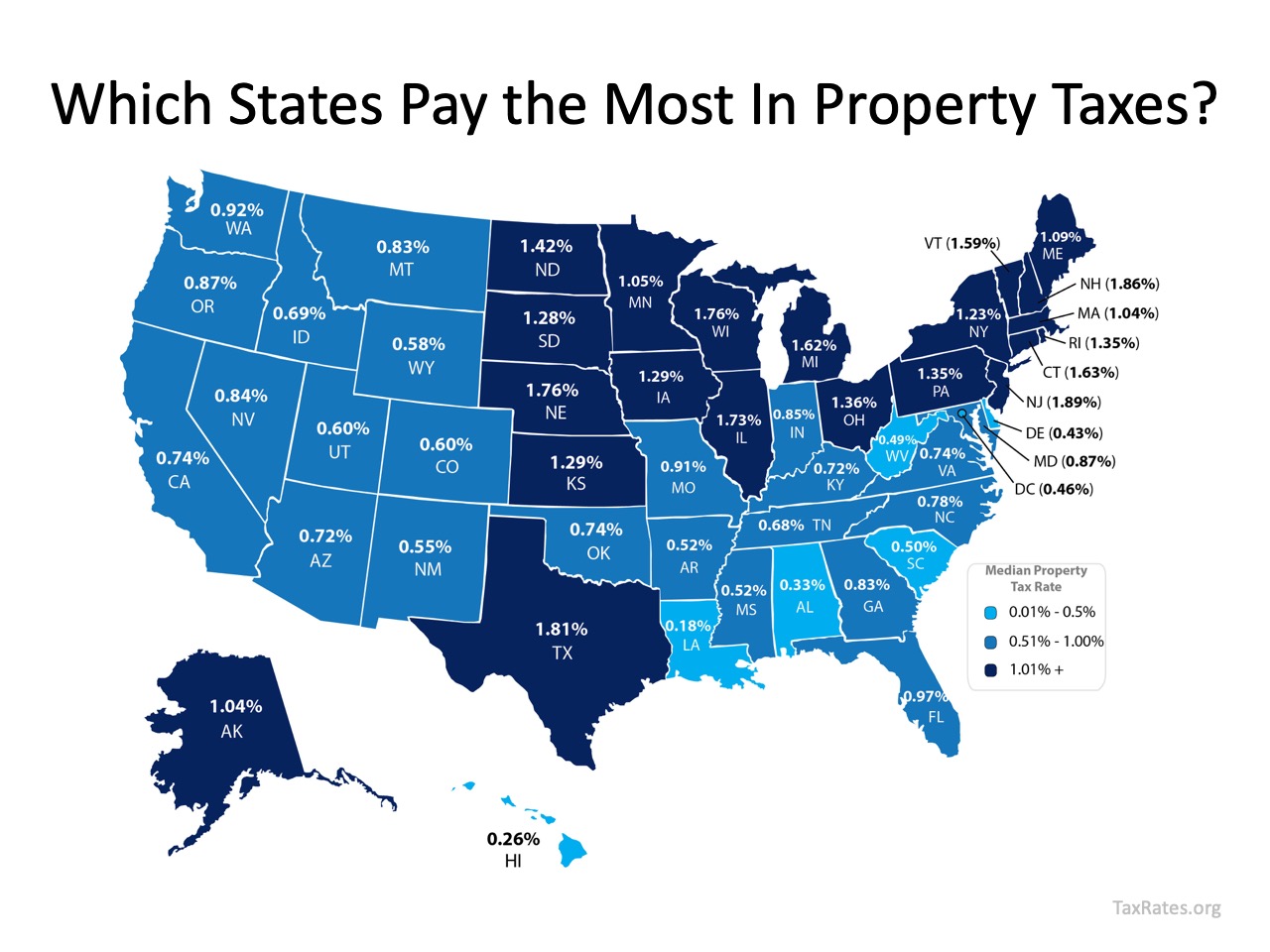

Property Taxes By State Map Map Vector What Is The Property Tax Rate In Wood County Ohio 2023 pay 2024 highest to lowest effective tax rates approved by the voters. Please visit the pages on the website for additional information. Rate of taxation in wood county, ohio for 2023. Below are links to real estate guidelines for wood county. In accordance with the ohio revised code, the wood county treasurer is responsible for collecting two kinds of. What Is The Property Tax Rate In Wood County Ohio.

From www.cleveland.com

Property tax rates increase across Northeast Ohio What Is The Property Tax Rate In Wood County Ohio Below are links to real estate guidelines for wood county. If you’re looking for information on a specific property, please visit our online property search database. Rate of taxation in wood county, ohio for 2023. Welcome to the wood county auditor. Please visit the pages on the website for additional information. The wood county auditor has the legal responsibility for. What Is The Property Tax Rate In Wood County Ohio.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet What Is The Property Tax Rate In Wood County Ohio In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. Rate of taxation in wood county, ohio for 2023. 2023 pay 2024 highest to lowest residential tax rate difference. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. If you’re looking for information on a specific property, please visit our online. What Is The Property Tax Rate In Wood County Ohio.

From lao.ca.gov

Understanding California’s Property Taxes What Is The Property Tax Rate In Wood County Ohio Below are links to real estate guidelines for wood county. Please visit the pages on the website for additional information. Below are quick links to the auditor’s most frequently used services. If you’re looking for information on a specific property, please visit our online property search database. The amount of real estate taxes are influenced by the value of the. What Is The Property Tax Rate In Wood County Ohio.

From www.aiophotoz.com

Ohio Tax By County Map Images and Photos finder What Is The Property Tax Rate In Wood County Ohio Please visit the pages on the website for additional information. Below are quick links to the auditor’s most frequently used services. The amount of real estate taxes are influenced by the value of the property which is decided by the wood county auditor and the tax levies which. 2023 pay 2024 highest to lowest effective tax rates approved by the. What Is The Property Tax Rate In Wood County Ohio.

From www.pennlive.com

Where are the highest property tax rates in central Pa.? What Is The Property Tax Rate In Wood County Ohio Below are links to real estate guidelines for wood county. In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. If you’re looking for information on a specific property, please visit our online property search database. The amount of real estate taxes are influenced by the value of the property which is decided by the. What Is The Property Tax Rate In Wood County Ohio.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today What Is The Property Tax Rate In Wood County Ohio If you’re looking for information on a specific property, please visit our online property search database. 2023 pay 2024 highest to lowest residential tax rate difference. The wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood county. In pursuance of section 323.08 revised code of the state of oho, i, jane. What Is The Property Tax Rate In Wood County Ohio.

From www.cleveland.com

Ohioans are spending more money on taxable things this year, including What Is The Property Tax Rate In Wood County Ohio Below are links to real estate guidelines for wood county. Please visit the pages on the website for additional information. In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. The amount of real estate taxes are influenced by the value of the property which is decided by the wood county auditor and the tax. What Is The Property Tax Rate In Wood County Ohio.

From flipboard.com

Total Property Taxes On SingleFamily Homes Up 4 Percent Across U.S. In What Is The Property Tax Rate In Wood County Ohio Please visit the pages on the website for additional information. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. The amount of real estate taxes are influenced by the value of the property which is decided by the wood county auditor. What Is The Property Tax Rate In Wood County Ohio.

From www.cleveland.com

What would Gov. John Kasich's proposed sales tax increase cost you? How What Is The Property Tax Rate In Wood County Ohio If you’re looking for information on a specific property, please visit our online property search database. In accordance with the ohio revised code, the wood county treasurer is responsible for collecting two kinds of property taxes: In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. Rate of taxation in wood county, ohio for 2023.. What Is The Property Tax Rate In Wood County Ohio.

From www.mof.gov.sg

MOF Press Releases What Is The Property Tax Rate In Wood County Ohio If you’re looking for information on a specific property, please visit our online property search database. 2023 pay 2024 highest to lowest residential tax rate difference. The wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood county. In pursuance of section 323.08 revised code of the state of oho, i, jane. What Is The Property Tax Rate In Wood County Ohio.

From wyomingtruth.org

Wyoming Boasts Most Favorable Small Business Tax Rates in US The What Is The Property Tax Rate In Wood County Ohio In accordance with the ohio revised code, the wood county treasurer is responsible for collecting two kinds of property taxes: The wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood county. In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. Welcome to the wood county. What Is The Property Tax Rate In Wood County Ohio.

From yellowhammernews.com

OUCH Alabama has 4th highest combined sales tax rate in the country What Is The Property Tax Rate In Wood County Ohio 2023 pay 2024 highest to lowest effective tax rates approved by the voters. If you’re looking for information on a specific property, please visit our online property search database. Rate of taxation in wood county, ohio for 2023. 2023 pay 2024 highest to lowest residential tax rate difference. The amount of real estate taxes are influenced by the value of. What Is The Property Tax Rate In Wood County Ohio.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax What Is The Property Tax Rate In Wood County Ohio The amount of real estate taxes are influenced by the value of the property which is decided by the wood county auditor and the tax levies which. If you’re looking for information on a specific property, please visit our online property search database. Welcome to the wood county auditor. The wood county auditor has the legal responsibility for valuing all. What Is The Property Tax Rate In Wood County Ohio.

From www.cleveland.com

Find out where your city or township ranks for property tax rates in What Is The Property Tax Rate In Wood County Ohio Below are links to real estate guidelines for wood county. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. The wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood county. Below are quick links to the auditor’s most frequently used services. In pursuance of section 323.08 revised. What Is The Property Tax Rate In Wood County Ohio.

From cumeu.com

Top 14 la county property tax payment inquiry 2022 What Is The Property Tax Rate In Wood County Ohio The amount of real estate taxes are influenced by the value of the property which is decided by the wood county auditor and the tax levies which. Rate of taxation in wood county, ohio for 2023. In pursuance of section 323.08 revised code of the state of oho, i, jane spoerl,. Below are links to real estate guidelines for wood. What Is The Property Tax Rate In Wood County Ohio.